Navigating Philippine Investment and Tax Updates

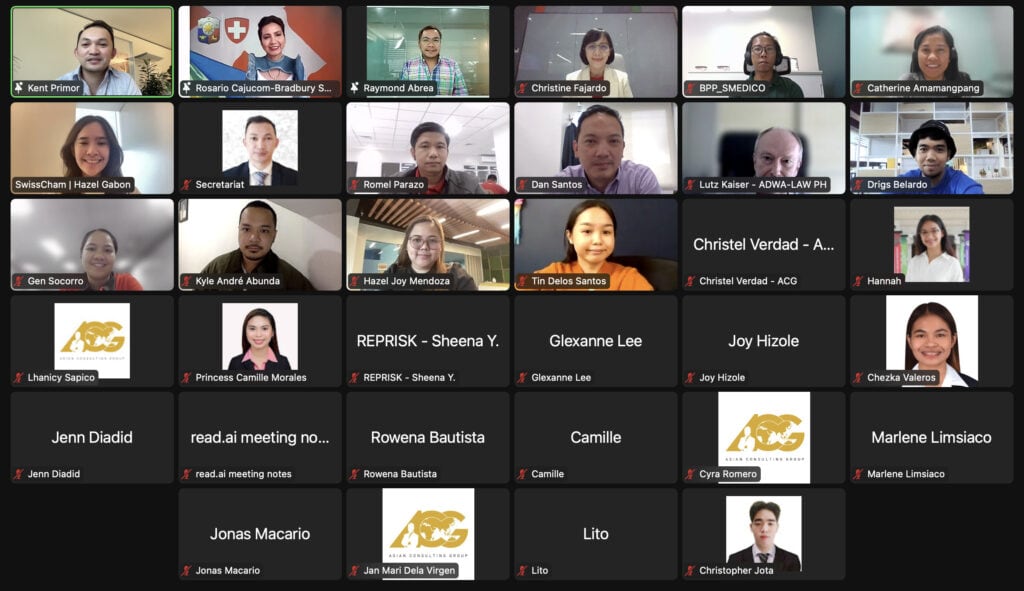

On June 20, 2024, the Swiss Chamber of Commerce of the Philippines in partnership with Asian Consulting Group hosted a highly informative webinar titled ‘Investments and Tax Updates in the Philippines’. The event aimed to keep members informed about the Philippine government's ongoing efforts to create a favorable investment environment while ensuring an equitable tax system.

Our speaker, Mr. Raymond Abrea, presented a comprehensive overview of the latest tax regulations, compliance requirements, and upcoming policy changes that could significantly impact business operations in the country. These include the recent tax law proposed amendments and its potential implications for businesses, providing guidance on maintaining compliance with the Bureau of Internal Revenue (BIR) and other regulatory bodies.

Mr. Abrea also discussed strategies for optimizing tax planning and compliance, helping businesses to better manage their tax liabilities while contributing to national development, and emphasized the importance of understanding the local tax environment to make informed investment decisions and foster long-term business success in the Philippines.

The Swiss Chamber of Commerce of the Philippines reiterates its commitment to supporting the business community by providing essential insights and resources. SwissCham extends an invitation to companies to join its network, offering access to exclusive events, industry updates, and advocacy initiatives aimed at enhancing business opportunities and promoting economic growth.

For membership inquiries and further information, please contact us at [email protected].